EVs and PHEVs are More Affordable Than Ever

Government and EPA initiatives to reduce carbon emissions have created attractive incentives to make purchasing or leasing Electric Vehicles (EVs) or Plug-In Hybrid Electric Vehicles (PHEVs) more affordable than ever. Various government agencies are now providing credits and incentives to boost the adoption of EVs.

These programs aim to help Coloradans of all income groups afford EVs and PHEVs, ensuring broader accessibility for everyone.

Make Green Choices, Reap Green Rewards

$5,000

$6,000

Vehicle Exchange Colorado Program

The Vehicle Exchange Colorado (VXC) program helps income-qualified Coloradans recycle and replace their old or high-emitting vehicles with electric vehicles (EVs). The VXC rebate will partially cover the upfront cost of the EV at the time of purchase or lease from an authorized automobile dealer.

We encourage income-qualified Colorado residents who own eligible old or high-emitting vehicles to apply for this rebate.

All Schomp Automotive Colorado dealerships are participating in Vehicle Exchange Program (VXC). For more information, contact a Schomp Client Advisor.

Colorado and Federal Tax Incentives

Federal Tax Incentives

All-electric, plug-in hybrid, and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to $7,500.

The credit availability will depend on several factors, including the vehicle’s MSRP, its final assembly location, battery component and/or critical minerals sourcing, and your modified adjusted gross income (AGI).

Manufacturers that do not qualify for the Federal Tax Credit have released comparable incentives to rival Federal Programs.

Colorado Tax Incentives

Colorado allows a refundable income tax credit for the purchase or lease of a qualifying motor vehicle. In general, the credit is allowed for new electric and plug-in hybrid electric motor vehicles that are titled and registered in Colorado, although several additional requirements apply. The amount of the credit varies by tax year. A purchaser or lessee of a qualifying motor vehicle can assign the credit to the financing entity or, for purchases or leases on or after January 1, 2024, to the motor vehicle dealer.

Energy Provider Rebates

- Up to $1,300 EV Charger and Wiring Rebate

Benefits of Driving an Electric Vehicle, PHEV, or Fuel Cell Electric Vehicle

- Save Money on Fuel and Maintenance

- Convenient Charging Accessibility

- Reduce Emissions and Your Carbon Footprint

- State-of-the-Art Technology

- An Improved Driving Experience

Did You Know?

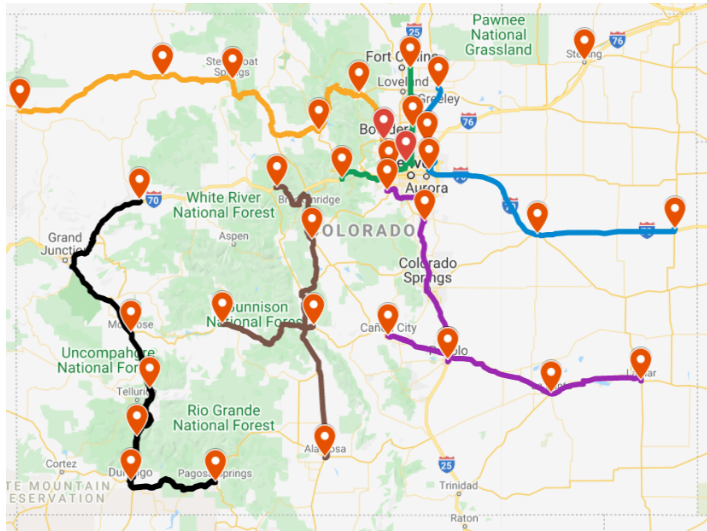

There are over 3,300 EV charging stations in Colorado!